In contrast to the relentless competition in the local lifestyle domain of TikTok, the downsizing of its community group buying, and the continued losses, the overseas expansion of food delivery might be Meituan’s most imaginative business venture. It has restored investor confidence, and Meituan is even considering spinning off and independently listing its overseas business once it matures.

Over the past year, Meituan’s overseas business, KeeTa, has disrupted the Hong Kong food delivery market like a catfish. Their next target is Riyadh, Saudi Arabia, a place with a per capita GDP of over 30,000 USD, where temperatures exceed 35°C for more than half the year and sandstorms are a common nuisance.

This marks Meituan’s first foray into international markets. The secrecy level of overseas business within the company is high, with a core local commerce employee at Meituan describing it as “mysterious.” The top management pays particular attention to it. At the beginning of this year, the person in charge of overseas business, who originally reported to Meituan’s Senior Vice President and head of core local commerce, Wang Puzhong, now reports directly to Meituan’s founder and chairman, Wang Xing.

Eight days after releasing a satisfactory financial report for the first quarter of 2024, Meituan immediately held its annual shareholders’ meeting for 2024. An attendee told Tech Planet that Wang Xing attended the meeting, which lasted about one hour. When discussing overseas business, Wang Xing stated that although the international business started late, it has already achieved the top market share in Hong Kong in terms of order volume. In the long term, Meituan will evaluate and organize more overseas markets such as Southeast Asia, Central Asia, and Europe.

The food delivery industry itself is challenging enough with high barriers to entry and frequent competitors, but no one has been able to shake Meituan’s position in the domestic market. Over the past three years, Meituan’s market value has plummeted from over 360 billion USD to less than 100 billion USD. Going overseas might allow Meituan to reach new heights.

If the Hong Kong market was just a trial, then Saudi Arabia might be the real beginning of Meituan’s overseas conquest.

KeeTa’s trial in Hong Kong saw order volumes surge to the top spot. Meituan’s overseas business has two teams, one in Beijing and the other in Hong Kong. Tech Planet learned that KeeTa has also established a customer service team, whose office is not in the expensive Causeway Bay with housing prices over 200,000 USD, but in the relatively cheaper Greater Bay Area.

On September 20th last year, KeeTa partnered with “Tam Jai Big Brother Rice Noodle,” known as the canteen for Hong Kong residents, to launch a single-person meal deal. The cost for a single meal was only 29 HKD, with free delivery, which was even cheaper than ordering takeout in mainland cities like Beijing, Shanghai, Guangzhou, and Shenzhen. This single-person meal set a record for monthly sales of a single item in the Hong Kong food delivery market in 2023, almost becoming Meituan’s most popular promotional event of the past year.

Many delivery riders reported that every Tam Jai Big Brother Rice Noodle they visited was overwhelmed with orders. According to Tech Planet, the original price of the single-person meal was 49.9 HKD, and with a delivery fee of 20-30 HKD, a single takeout meal would cost 70-80 HKD. However, this promotion was limited to a season and only lasted for three days.

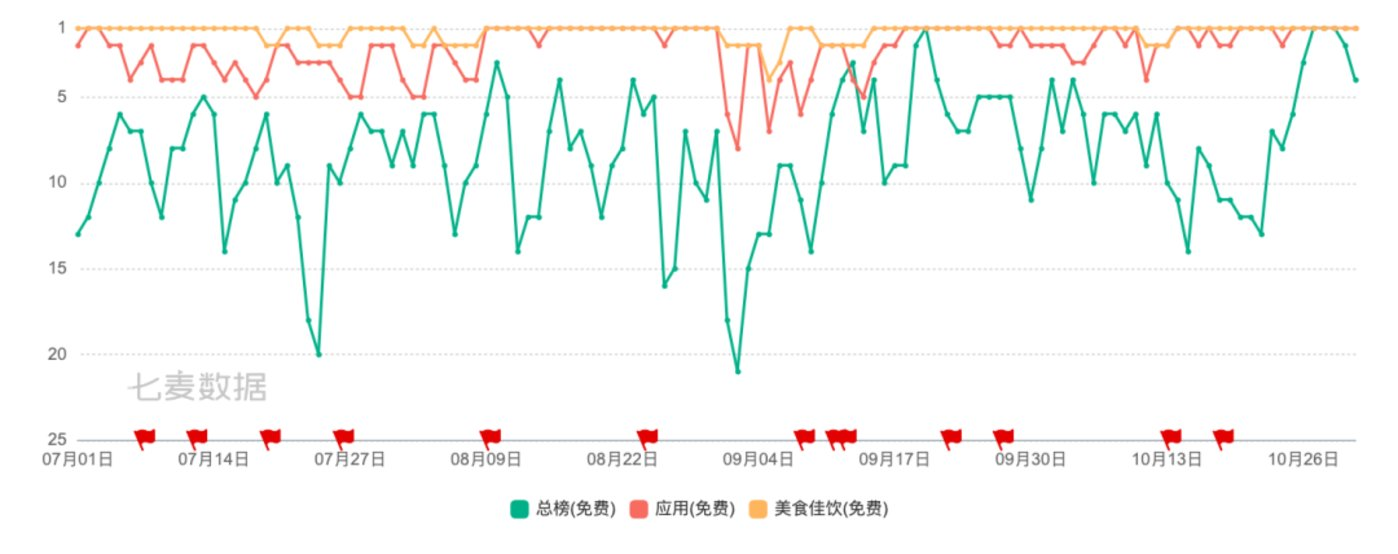

Subsidies in cash remain the most immediate method. Data from Qimai shows that on September 20th, KeeTa topped the free app download chart on the Hong Kong App Store.

According to statistics from Measurable AI, a China Hong Kong MDT ecological alternative data service provider, as of March 2024, the market share of food delivery orders on Meituan’s platform, KeeTa, has soared to 44%, making it the largest food delivery platform in terms of order volume in the Hong Kong market. A KeeTa employee stated that the actual order volume proportion has exceeded 44%, but in terms of GMV, KeeTa is not yet number one.

KeeTa’s rise to the top in terms of order volume in Hong Kong is partly due to its “One Person Canteen” project. In the “One Person Canteen,” the per capita price of many meals is even lower than dining in, and with delivery fee discounts, as of May 22, 2019, 2.01 million users have downloaded the app, which means nearly 30% of Hong Kong residents are already KeeTa users. Currently, more than 10,000 restaurants have joined, covering a variety of cuisines including Chinese, Western, Japanese, Korean, and Thai.

In mainland China, Meituan’s algorithm optimization allows delivery riders to deliver takeout to consumers as quickly as possible, and KeeTa’s delivery efficiency has indeed received a lot of praise from consumers. At the beginning of the launch, KeeTa introduced a punctuality guarantee service, and currently, the punctuality rate is stable at over 98%, with an average delivery time of less than 30 minutes.

Tech Planet learned that in April this year, KeeTa held a rider exchange meeting, which was divided into Chinese and English versions. According to a report from the “21st Century Economic Report,” KeeTa’s operators revealed that the average online time of riders has declined, and some riders at this meeting reported that compared with the early days of operation, the current delivery time has been shortened a lot, while the order remuneration of other food delivery platforms has risen.

A rider who attended the meeting told Tech Planet that the meeting mainly hopes to optimize some product and process designs through rider feedback, such as responsibility judgment and dispatch distance.

In mainland China, no matter from which indicator, Meituan is the absolute first in the food delivery industry. The aforementioned rider told Tech Planet that because KeeTa has not yet achieved an absolute first place in Hong Kong, blindly copying the domestic approach may not be ideal.

A “pedestrian rider” deliveryman said that in the Hong Kong market, the other two food delivery platforms, Foodpanda and Delivery, and KeeTa still each have their advantages. For example, Foodpanda is more friendly to full-time riders, who can choose their delivery time preferentially. In addition to takeout, there are also department stores with a more complete range of categories.

In other words, although Meituan has made breakthrough progress in the Hong Kong market, if it wants to replicate the situation in the mainland China market, it still needs to work hard.

Riyadh with more intense competition When KeeTa was listed in Hong Kong, an employee told Tech Planet that Hong Kong was just a trial, to understand the entire process, with the goal of going abroad.

Unlike e-commerce going overseas, TikTok and Temu either choose Southeast Asia or Europe and America as their first stop, but KeeTa chose Saudi Arabia in the Middle East, with the first stop being its capital, Riyadh.

A partner of a Chinese-funded organization told Tech Planet that Saudi Arabia has a higher population base than the United Arab Emirates, with a population of 35 million, 60%-70% of whom are local and relatively wealthy. Although the living environment is not comfortable, they are not unfamiliar with food delivery services, most people order meals in units of families, and the minimum order amount is as high as 15 Saudi Riyals, nearly 30 RMB.

The food delivery market in Saudi Arabia is not an undeveloped blue ocean, but a fiercely competitive red ocean. The Middle East’s first food delivery company, Talabat, was established as early as 2004. KeeTa entering Saudi Arabia will face three major competitors: Jahez, a local food delivery platform established in 2016; Hunger Station, a subsidiary of Germany’s food delivery giant Deliver Hero; and Uber Eats from the United States.

In addition, there are more than ten platforms providing delivery services, including the aggregation platform Wssel. According to Tech Planet, in June this year, another food delivery platform from Southeast Asia, Wukong Delivery, has also entered Saudi Arabia.

But the market still has considerable growth potential. Statista estimates that the total revenue of the food delivery market in Saudi Arabia is expected to reach 11.74 billion USD in 2024, and the user penetration rate of the food delivery market will reach 44.2%. In contrast, China, as the world’s largest food delivery market, is expected to have a user penetration rate of 54.5%. The minimum order amount is 100 Saudi Riyals, nearly 200 RMB.

It is not easy for Meituan to continue the myth of Hong Kong in Saudi Arabia. Tech Planet learned that the first restaurant KeeTa signed in Saudi Arabia is a Chinese restaurant specializing in Hunan cuisine. The restaurant staff said that KeeTa’s employees had been eating in the restaurant for more than a month because they wanted to test the food delivery, and the two sides quickly reached an agreement.

A person close to KeeTa’s core team in Saudi Arabia told Tech Planet that most of the restaurants Meituan has signed in Saudi Arabia are Chinese restaurants, but Meituan still wants to be a comprehensive food delivery platform.